As countries step up their climate ambitions, clean energy technologies are set to become the fastest-growing segment of demand for most minerals. According to the International Energy Agency, energy transitions are already the major driving force for total demand growth for some minerals. It seems like a paradox: to switch from dirty fossil fuel energy sources to carbon-free renewables and electric vehicles, we need more mining that is, historically, one of the most polluting sectors. Indeed, the clean technologies – from wind turbines to solar panels, passing to battery storage – require a wide range of rare-earth elements and metals, usually referred to as “critical materials”. Their type and volume needs vary widely across the spectrum of technologies, as well as their abundance into the Earth’s crust.

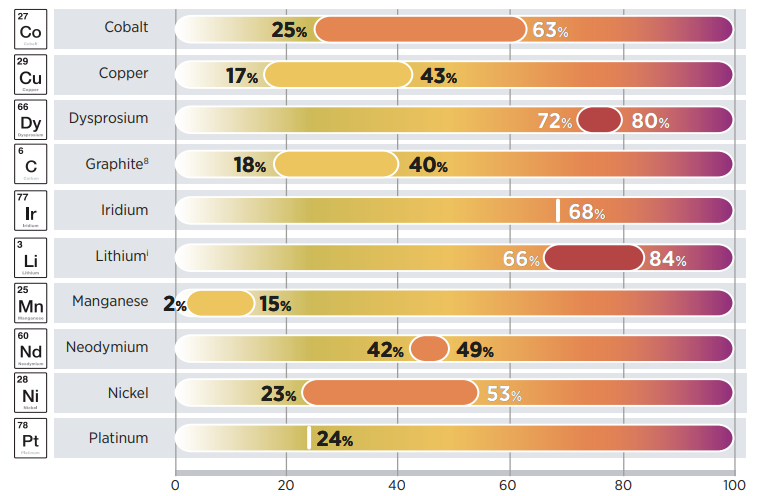

Critical materials are today the focus of much international dialogue and diplomacy, as warned by a new report by the International Renewable Energy Agency (IRENA). While there is no scarcity of reserves for energy transition minerals, global capabilities for mining and refining them are limited. Their production and processing are highly concentrated geographically – with a few countries and few major companies playing a dominant role – posing challenges related to resource security and geopolitical dynamics. Today, the mining of critical materials is highly concentrated in specific geographical locations. Australia (lithium), China (graphite, rare earths), Chile (copper and lithium), the Democratic Republic of Congo (cobalt), Indonesia (nickel) and South Africa (platinum, iridium) are the dominant players. Processing is even more geographically concentrated, with China accounting for more than 50% of the world’s refined supply of natural graphite, dysprosium, cobalt, lithium, and manganese.

Unlike the supply disruptions of fossil fuels, those of critical materials have a minimal impact on energy security, but a huge impact on the energy transition because they could affect its speed in the short to medium term. External shocks, resource nationalism, export restrictions, mineral cartels, instability, and market manipulation could therefore increase the risks of supply shortages. The full extent of reliance and exposure to disruptions is not always obvious. Mineral commodities sourced from different countries can be embedded in imported finished and semi-finished products, thus obscuring potential links and vulnerabilities.

The centralised supply chains for many materials are likely to remain as they are for the foreseeable future. Many countries are trying to restructure supply chains, but new mining and processing facilities have long lead times, making it difficult to rebalance supply and demand dynamics. Stockpiling of energy transition technologies is not a robust solution for mitigating supply risks. If not handled judiciously, stockpiling can exacerbate market limitations, drive up prices, and lead to an uneven energy transition that excludes poorer countries and delays climate action. An alternative source of critical materials could be represented by urban mining which is based on the value recovery of secondary raw materials from anthropogenic sources through biological, chemical, or physical procedures and technological input. Regional cooperation could help countries capture a greater share of the value of producing minerals. Rather than pursuing one-on-one deals with foreign companies, co-ordinated regional approaches could be more effective in ensuring that conditions attached to foreign investment are favourable for mineral rich countries. Coordination across regions is also important, as most countries will benefit from pooling respective mineral supplies if they intend to build downstream industries.

Geographically widespread material reserves open opportunities to diversify the mining and processing to notably developing countries. The IRENA report highlights the opportunity to rewrite the script for extractive commodities and build the momentum for more inclusive, ethical, and sustainable value chains. As has been the case with extractive industries for centuries – and even with today’s awareness and standards – mining activities and processes carry risks for local communities such as labour and other human rights abuses, land degradation, water resource depletion and contamination, and air pollution. Stronger international co-operation to raise and enforce standards and longer-term corporate views will be essential for sustainable development and social licence. Supporting policies will allow developing countries to realise new business opportunities and could improve resilience while keeping the global decarbonisation agenda on course.

“The significant increase in critical materials gives the international community an opportunity to diversify supply chains and make them more sustainable. No single country can alone fulfil its demand for materials, so collaborative strategies that benefit all involved need to be developed and implemented. Particularly mineral-rich developing countries gain if they can capture a greater share of the critical material value chain. By redefining the narrative of extraction, we can promote a more responsible approach to the benefit of people and communities in pursuit of inclusive and resilient economies” said Francesco La Camera, Director-General of IRENA.

Picture Credits CC from Khusen Rustamov on Pixabay