As our planet increasingly faces the unpredictable consequences of climate change and resource depletion, urgent action is needed to adapt to a more sustainable model. Around 180 billion Euros of additional investments a year are needed to achieve the EU’s 2030 targets agreed in Paris, including a 40% cut in greenhouse gas emissions.

Global investments hold the key to fighting climate change, with trillions already invested in solutions such as renewables and energy efficiency. The Paris Agreement could represent a massive investment opportunity. How to unlock it? Re-orienting private capital to more sustainable investments, which requires a comprehensive rethinking of how our financial system works. This is necessary if the EU is to develop more sustainable economic growth, ensure the stability of the financial system, and foster more transparency and long-termism in the economy.

The EU’s taxonomy will allow investors to clearly know whether an investment is truly green or not. This is extremely important in order to activate private capital for the green transition.

Jaroslav Mysiak, CMCC Foundation

The process of taking due account of environmental, social and governance (ESG) considerations when making investment decisions in the financial sector: this is generally what we define as sustainable finance, leading to increased longer-term investments into sustainable economic activities and projects. More specifically, environmental considerations may refer to climate change mitigation and adaptation, as well as the environment more broadly, such as the preservation of biodiversity, pollution prevention and circular economy.

On the other hand, social considerations are also taken into account and refer to issues of inequality, inclusiveness, labour relations, investment in human capital and communities, as well as human rights issues. In the EU’s policy context, sustainable finance is understood as finance to support economic growth while reducing pressures on the environment and taking social and governance aspects into account. Sustainable finance also encompasses transparency on risks related to ESG factors that may impact the financial system, and the mitigation of such risks through the appropriate governance of financial and corporate actors.

This is why, on the basis of the recommendations set out by the High-Level Expert Group on sustainable finance (HLEG), the European Commission (EC) put together a roadmap in 2018 to boost the role of finance in achieving a well-performing economy that delivers on environmental and social goals as well. The action plan on sustainable finance set out a comprehensive strategy to further connect finance with sustainability, while highlighting 10 key actions to be implemented in order to reorient capital flows towards a more sustainable economy, mainstreaming sustainability into risk management and fostering transparency and long-termism.

This comprehensive set of recommendations for the financial sector to support the transition to a low-carbon economy include: establishing a common language for sustainable finance, i.e. a unified EU classification system – or taxonomy – to define what is sustainable and identify areas where sustainable investment can make the biggest impact; creating EU Green Bond Standard and labels for green financial products on the basis of this EU classification system: this will allow investors to easily identify investments that comply with green or low-carbon criteria; clarifying the duty of asset managers and institutional investors to take sustainability into account in the investment process and enhance disclosure requirements; requiring insurance and investment firms to advise clients on the basis of their preferences on sustainability; incorporating sustainability in prudential requirements: banks and insurance companies are an important source of external finance for the European economy.

The Commission will explore the feasibility of recalibrating capital requirements for banks (the so-called green supporting factor) for sustainable investments, when it is justified from a risk perspective, while ensuring that financial stability is safeguarded. Moreover, the action plan aims at enhancing transparency in corporate reporting.

A framework to facilitate sustainable investments

The EU’s classification of green economic activities, or taxonomy, represents the world’s first-ever “green list” and will create a common language that investors can use everywhere when investing in projects and economic activities that have a substantial positive impact on the climate and the environment.

“It will help scale up private and public investments to finance the transition to a climate-neutral and green economy, redirecting capital to economic activities and projects that are truly sustainable”, explains Jaroslav Mysiak, Director of Risk Assessment and Adaptation Strategies research at the CMCC Foundation.

“It will allow investors to clearly know whether an investment is truly green or not. This is extremely important in order to activate private capital for the green transition” he adds.

Using this classification, the EU wants to manage and take into account what the experts call “transitional risks”, that is risks link to the green transition, highlighting for investors how each sector contributes, or doesn’t, with activities to be considered more sustainable or not. A practical guide for policymakers, industry and investors on best practices for supporting and investing in economic activities that contribute to achieving a climate neutral economy.

The Technical Expert Group on sustainable finance has extensively screened activities across a wide range of sectors, including energy, transport, agriculture, manufacturing, ICT and real-estate. It has identified low-carbon activities like zero-emissions transport but also transition activities like manufacturing of iron and steel, in order to compile the most comprehensive classification system for sustainable activities to date.

“The European Commission also has a Directive and many initiatives related to non-financial disclosures (ESG), addressing how firms can follow some principles that are not strictly linked to profits, but also draw on social and environmental values,” continues Jaroslav Mysiak.

These guidelines aim to improve how firms report climate-related information and orient the choice of investors who wish to adopt a climate-conscious investment strategy while addressing the risk of greenwashing. They also set out disclosure requirements by benchmark providers in relation to ESG factors and their alignment with the Paris agreement.

The reports are part of the Commission’s ongoing efforts to ensure that the financial sector – private capital – can play a critical role in transitioning to a climate-neutral economy and in funding investments at the scale required. They will provide guidance to around 6,000 EU-listed companies, banks and insurance companies that have to disclose non-financial information.

So, how can we leverage the private sector role in fostering public funding for mitigation and adaptation? “By aligning private investors on community targets, improving their environmental and social awareness and orienting them towards types of objectives that provide benefits for all of society.”

Jaroslav Mysiak, CMCC Foundation

“Another strategy is to create a suitable environment for investments through incentives; in other words, you can make investors more responsible by increasing their responsibility towards society and environment, or you can persuade investors by making them understand that they can generate more profits from these kinds of investments,” he continues.

Green bonds as a key instrument to unlock climate finance

Bonds are fixed income instruments involving loans made by an investor (or creditor) to a borrower such as companies or governments to finance projects. Bonds specify the end date when the principal of the loan is due to be paid and include the terms for interest payments. Green bonds are bonds that have positive environmental and/or climate benefits and play an increasingly important role in financing assets needed for the low-carbon transition.

“First introduced by the European Investment Bank (EIB) in 2007, green bonds received a special attention from the private sector, particularly since 2013, and are expected to play an important role in financing the transition to a carbon neutral and resilient Europe and the Next Generation EU recovery plan,” explains Mysiak.

The EIB remains a world leader issuer of green bonds with over €30 billion raised in 2020. The European Bank for Reconstruction and Development (EBRD), the first Multilateral Development Bank with an explicit requirement in its mandate to promote environmentally sound and sustainable development, releases green bonds as well (Environmental Sustainability Bonds issued since 2010, Climate Resilience Bonds and Green Transition Bonds introduced in 2019), with funds raised being used to finance environmental sustainability projects, e.g. projects to provide environmental benefits, reduce environmental and climate-related risks, or to speed up the energy transition.

Moreover, catastrophe or CAT bonds are instruments used to obtain a financial coverage to climate-related events. If a major catastrophe occurs (e.g. hurricane), investors will lose the capital invested in part or at all and the issuer will use that money to recover from the damage. Resilient impact bonds are bonds through which an investor is remunerated based on how well resilient measures are implemented, according to pre-defined performance indices.

The EU is currently setting its green bond standards as part of broader measures to spur the take-up of sustainable finance in Europe (see references for a complete bibliography on this issue). In 2019, the Commission’s Technical Expert Group on Sustainable Finance (TEG) published its report on EU Green Bond Standard, recently updated with its usability guide for the EU Green Bond Standard. The report proposes that the Commission creates a voluntary EU Green Bond Standard to enhance the effectiveness, transparency, comparability and credibility of the green bond market and to encourage market participants to issue and invest in EU green bonds.

The guide offers market actors guidance on the use of the proposed standard and the set-up of a market-based registration scheme for external verifiers. Moreover, the usability guide contains an updated proposal for a green bond standard.

A study published on Nature Climate Change exploring the US landscape of conventional and green bonds, highlights that historically green bonds have been penalized on the municipal market, being traded at lower prices and higher yields than expected by their credit profiles. In recent years, however, the situation has changed following the rise of the credit quality of green bonds on the municipal market, and the premium turned positive. Green bonds are thus becoming an increasingly attractive investment, with scope to bridge the climate finance gap for mitigation and adaptation.

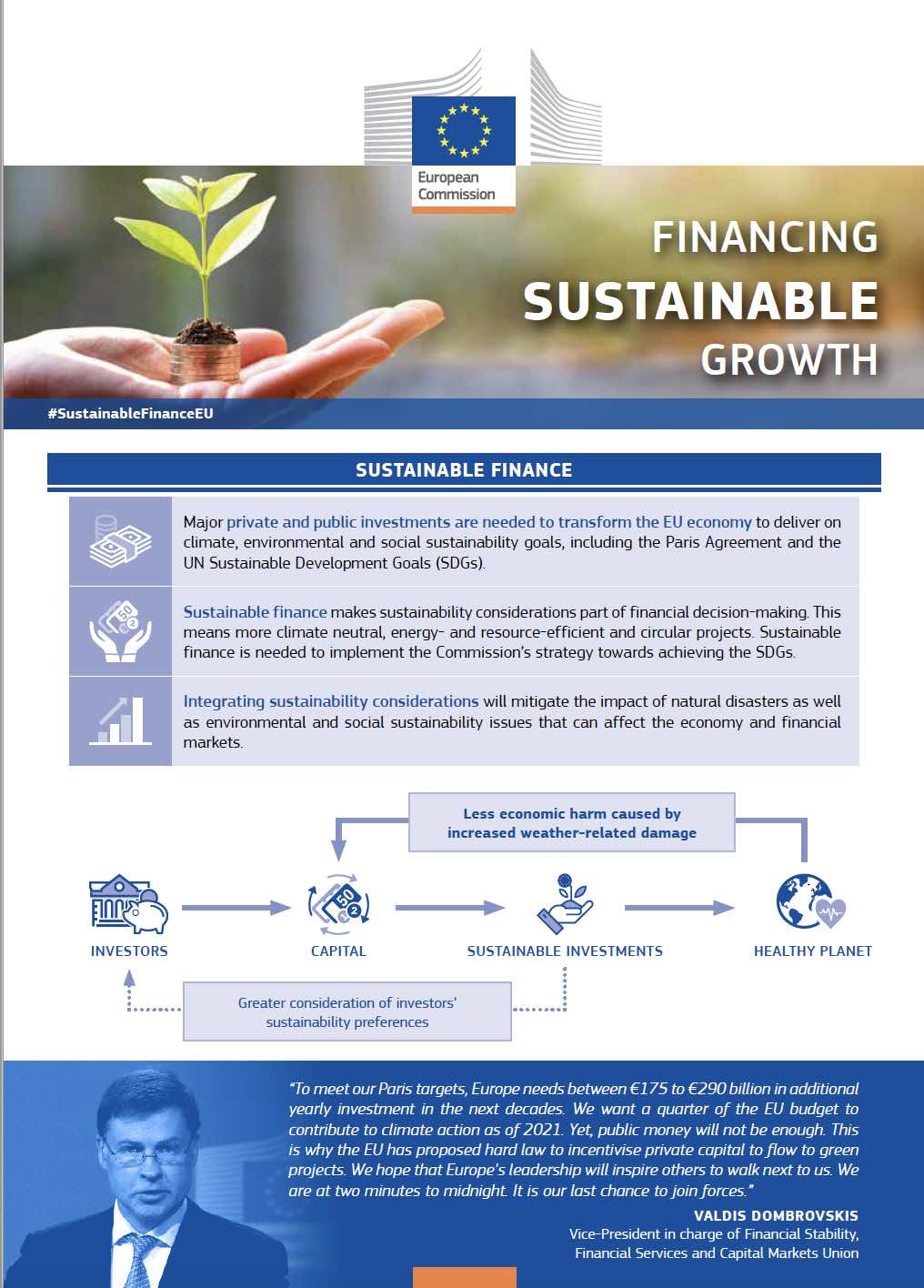

Finally, major private and public investments are needed to transform the EU economy to deliver on climate, environmental and social sustainability goals. Sustainable finance makes sustainability considerations part of financial decision-making and will be crucial to implement the Commission’s strategy towards achieving the Paris Agreement and the UN Sustainable Development Goals (SDGs).

References

Commission action plan on financing sustainable growth

The EU taxonomy for sustainable activities

The EU climate benchmarks and benchmarks’ ESG disclosures

Factsheet: Financing sustainable growth

Karpf, A., Mandel, A. The changing value of the ‘green’ label on the US municipal bond market. Nature Clim Change 8, 161–165 (2018). https://doi.org/10.1038/s41558-017-0062-0