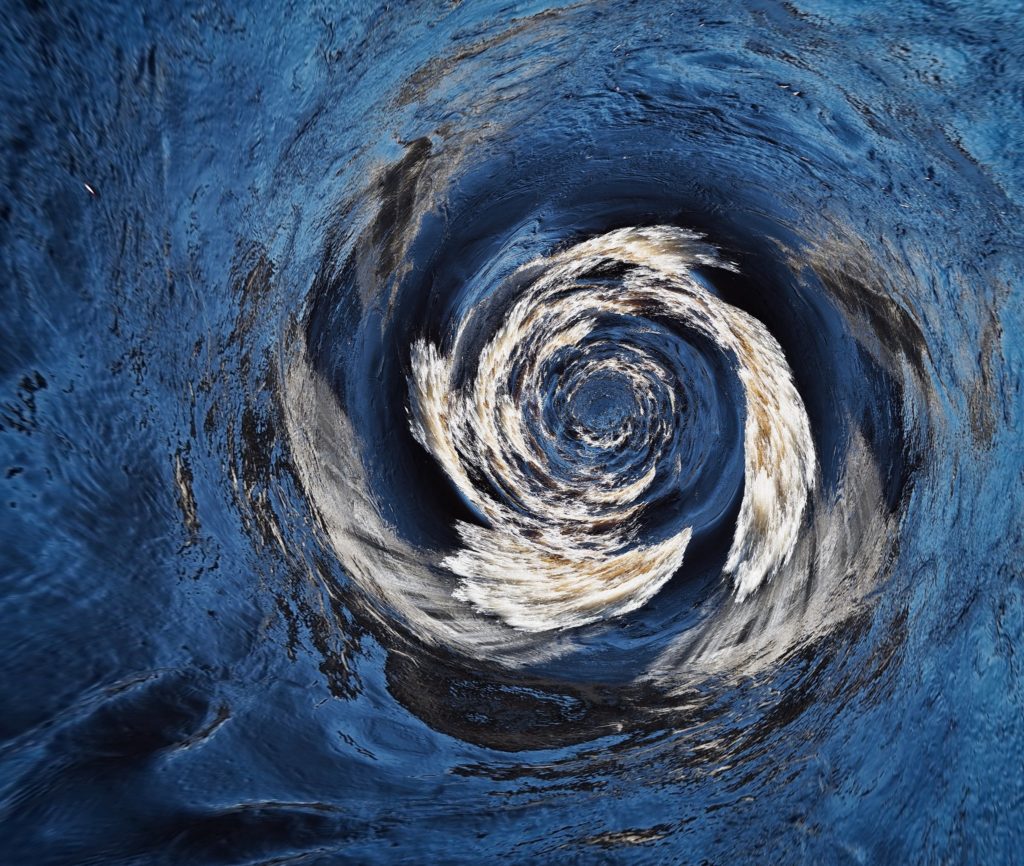

Be prepared for the polycrisis era

Diverse crises spanning over three different timeframes. They are interconnected and put us in the middle of a shift in power. This is the time to adapt ourselves to a “new order”, but this is also a period of crucial opportunity for moving forward. Insights from the Global Risks Report 2023.